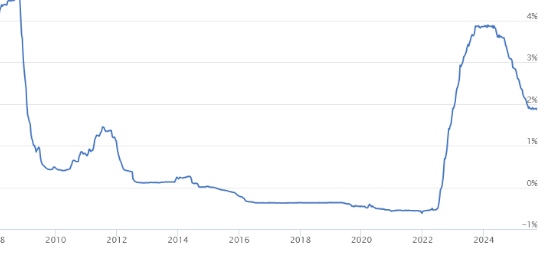

Falling Interest Rates Create Favourable Conditions for Home Buyers

The average interest rate on new mortgage contracts in Portugal fell to 2.91% in June 2025, according to the Bank of Portugal (BdP). This marks the lowest level since October 2022 and reflects a downward trend that has continued for several months.

New Mortgage Rates: Three-Month Review

Key Highlights:

- June 2025: The average rate on new housing loans dropped to 2.91%, the 19th decrease in 20 months.

- Driven by Euribor: The fall is largely explained by the decline in the Euribor, the main benchmark for Portuguese mortgages, which has been steadily decreasing.

- European Context: Portugal now records one of the lowest average mortgage rates in the Euro Area, remaining below the eurozone average in June 2025.

- Impact for Borrowers: Lower interest rates mean more manageable monthly repayments, making this an ideal time to arrange a mortgage or transfer an existing loan. An additional advance could also be considered to fund home improvements or the purchase of a new car.

In Portugal, a Range of Mortgage Solutions is Available:

- Purchase – to finance the acquisition of a residence or investment property.

- Transfer (Refinancing) – to move an existing loan to another bank under more favourable terms.

- Construction – to fund the building of a property or significant renovations, with staged disbursements.

- Equity Release – to access capital tied up in a property whilst retaining ownership.

If You Have Questions, Please Don’t Hesitate To Contact Me.

Corinne Ferreira – Senior Mortgage Advisor